Real estate can be rented on a short-term basis, such as seasonal or vacation rentals, or on a long-term basis, such as traditional residential leases (primary residence, secondary residence, company lease). Each option has its advantages and disadvantages for landlords. In this article, we take a closer look at the advantages and disadvantages of each option, so that you can make an informed decision.

ADVANTAGES OF SHORT-TERM SEASONAL RENTALS

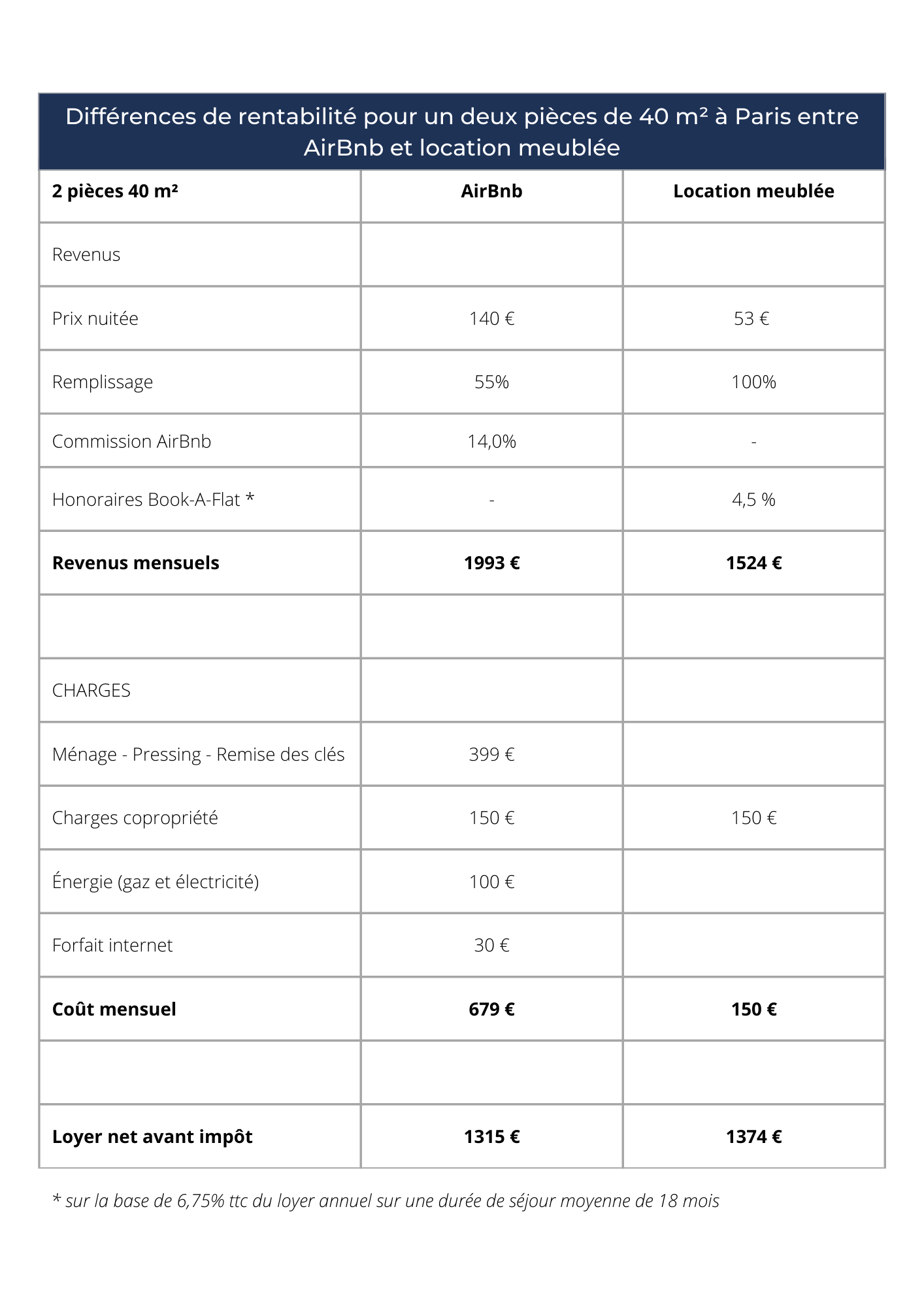

Higher short-term revenues: short-term rentals generally allow owners to charge higher rates per night, which can result in higher a priori revenues compared to long-term rentals.

Higher short-term revenues: short-term rentals generally allow owners to charge higher rates per night, which can result in higher a priori revenues compared to long-term rentals. Flexibility: owners can use their property for personal purposes during periods when it's not being rented out, offering greater flexibility.

Flexibility: owners can use their property for personal purposes during periods when it's not being rented out, offering greater flexibility.

DISADVANTAGES OF SHORT-TERM SEASONAL RENTALS

Rapid wear and tear of the apartment: as the average length of stay is 3 days, turnover is high, with tourists reluctant to keep the apartment intact. Additional renovation and furnishing costs need to be factored into your business plan, or a much higher initial investment with (very) robust materials. Mattresses, undersheets, tables, sofas and crockery are damaged much more quickly by short-term tenants.

Rapid wear and tear of the apartment: as the average length of stay is 3 days, turnover is high, with tourists reluctant to keep the apartment intact. Additional renovation and furnishing costs need to be factored into your business plan, or a much higher initial investment with (very) robust materials. Mattresses, undersheets, tables, sofas and crockery are damaged much more quickly by short-term tenants. Intensive management: short-term rentals generally require more intensive management, with tasks such as greeting guests, frequent cleaning, managing bookings, and so on. If you also have a professional activity or don't have the time to take care of it, don't bother, or contract with a concierge service whose fees range from 15 to 25% of the turnover received.

Intensive management: short-term rentals generally require more intensive management, with tasks such as greeting guests, frequent cleaning, managing bookings, and so on. If you also have a professional activity or don't have the time to take care of it, don't bother, or contract with a concierge service whose fees range from 15 to 25% of the turnover received. Seasonal fluctuations: income can vary considerably according to the seasons and tourist demand, which can make it difficult to forecast income over the long term. If you're in Paris, spring and summer are peak periods, but it can be difficult to find tenants in winter, even if you cut your rates sharply.

Seasonal fluctuations: income can vary considerably according to the seasons and tourist demand, which can make it difficult to forecast income over the long term. If you're in Paris, spring and summer are peak periods, but it can be difficult to find tenants in winter, even if you cut your rates sharply. Local regulations: in some cities, there may be strict regulations concerning short-term rentals, such as restrictions on duration or the requirement to obtain special licenses. In Paris, for example, since December 1, 2017, Parisian homeowners can only rent out their primary residence for a maximum of 120 days per year. Any owner wishing to rent out their apartment on a short-term basis in Paris must obtain a registration number from the city hall. This involves declaring your property and obtaining a unique registration number to use in your advertisements. You must also collect the "taxe de séjour" (tourist tax) from your tenants and pay it to Paris City Hall. The amount of this tax varies according to the category of your accommodation. If your apartment is located in a condominium, make sure you comply with the rules set out in the condominium bylaws. Some buildings may prohibit short-term rentals, or have specific restrictions in this regard. If you fail to comply with these regulations, be aware that the authorities are becoming increasingly vigilant and may take you to court.

Local regulations: in some cities, there may be strict regulations concerning short-term rentals, such as restrictions on duration or the requirement to obtain special licenses. In Paris, for example, since December 1, 2017, Parisian homeowners can only rent out their primary residence for a maximum of 120 days per year. Any owner wishing to rent out their apartment on a short-term basis in Paris must obtain a registration number from the city hall. This involves declaring your property and obtaining a unique registration number to use in your advertisements. You must also collect the "taxe de séjour" (tourist tax) from your tenants and pay it to Paris City Hall. The amount of this tax varies according to the category of your accommodation. If your apartment is located in a condominium, make sure you comply with the rules set out in the condominium bylaws. Some buildings may prohibit short-term rentals, or have specific restrictions in this regard. If you fail to comply with these regulations, be aware that the authorities are becoming increasingly vigilant and may take you to court.

ADVANTAGES OF LONG-TERM RENTAL

Stable income: long-term rentals generally offer more stable income, as tenants sign longer leases. For example, try simulating your rent with our online Rent Estimate tool. This will give you a rent range, which you can then refine with one of our Book-A-Flat collaborators.

Stable income: long-term rentals generally offer more stable income, as tenants sign longer leases. For example, try simulating your rent with our online Rent Estimate tool. This will give you a rent range, which you can then refine with one of our Book-A-Flat collaborators.-

Less management: once long-term tenants are in place, day-to-day management can be less intensive, with less turnover and maintenance requirements. Nevertheless, this requires a level of availability that not everyone can afford. That's why Book-A-Flat offers a rental management service:

Less management: once long-term tenants are in place, day-to-day management can be less intensive, with less turnover and maintenance requirements. Nevertheless, this requires a level of availability that not everyone can afford. That's why Book-A-Flat offers a rental management service: - Rent calls, receipts

- Rent payments between the 5th and 10th of each month

- Issuance of a document to help with tax returns

- Annual upward rent review

- Entry and exit inventories

- Repurchase of missing equipment

- Housekeeping between two rentals

- Complete tenant relationship management

- Intervention, quotation and follow-up in the event of technical problems or claims

- Monthly management report

Legal protection: one-year leases offer greater protection for landlords, as they establish clear rights and responsibilities for both parties. Book-a-Flat takes care of the entire contractual process, ensuring that financial funds are received on time.

Legal protection: one-year leases offer greater protection for landlords, as they establish clear rights and responsibilities for both parties. Book-a-Flat takes care of the entire contractual process, ensuring that financial funds are received on time.

DISADVANTAGES OF LONG-TERM RENTAL

Lower income: long-term leasing income is generally lower than short-term rental income. However, there is no turnover or seasonality, and the expected occupancy rate is 100%!

Lower income: long-term leasing income is generally lower than short-term rental income. However, there is no turnover or seasonality, and the expected occupancy rate is 100%! Less flexibility of use: unlike seasonal rentals, the apartment is fully occupied by a tenant. The owner cannot use the apartment whenever he or she wishes.

Less flexibility of use: unlike seasonal rentals, the apartment is fully occupied by a tenant. The owner cannot use the apartment whenever he or she wishes.

CONCLUSION

Choosing between short- and long-term rental depends on financial objectives, personal circumstances and owner preferences. Short-term rental may seem more attractive financially, but it generates stress and additional costs that are often poorly anticipated by investor-owners.

Long-term rental offers stable income and less management. It's important for owners to weigh up these advantages and disadvantages carefully in order to make the best decision for their property. To find out more, take a look at our white paper on rental investment.

Article published on 06/13/2023, written by Alexandre Couronne

Related articles

List your apartment

Find all of our articles for a successful furnished rental in Paris:

Renting guide List your apartment